Saving money is a crucial aspect of managing my finances and building a secure financial future. It can be challenging to set aside money each month, but the benefits of saving far outweigh the temporary discomfort of forgoing immediate spending. For me, One way to make saving easier is by using a digital bank like Maya.

I’ve been using Maya Digital Bank even before. (It was named PayMaya), and it’s been a game-changer for me when it comes to managing my finances.

Before I switched to Maya, I was using another digital banking and wasn’t really happy with the service and the low-interest rates they offered on my savings account.

One of the things I love most about Maya is the high-interest rates they offer on their savings accounts, currently at 6% per annum. It’s been great to see my money grow faster than it would with a traditional bank and other digital banks. I appreciate that there are no minimum balance requirements or monthly fees. This has really helped me to save more money and reach my financial goals more quickly.

In addition to the high-interest rates, I’ve also appreciated the convenience of using a digital bank. With Maya, I can manage my account and make transactions from the comfort of my own home, using my smartphone or computer. This has been especially useful during the pandemic when it wasn’t always possible or safe to visit a physical bank branch.

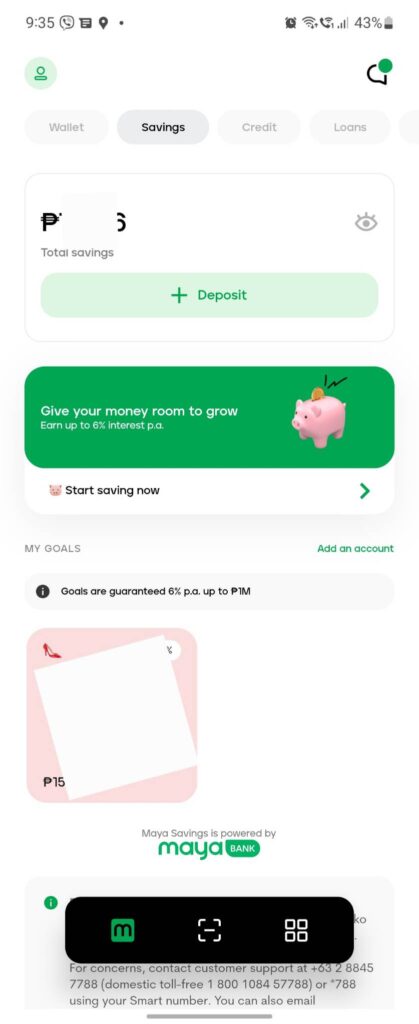

Another feature I really appreciate is the range of tools and resources that Maya provides to help me manage my money and reach my financial goals. The budgeting and financial planning tools have been especially helpful in keeping track of my spending and savings. I’ve also found the Personal Goals feature to be really useful in organizing my financial goals and tracking my progress.

Here are some of the top benefits of using Maya:

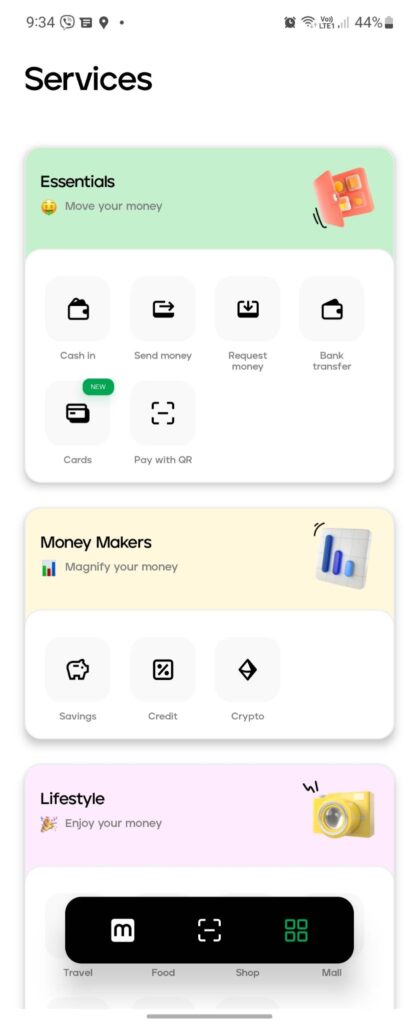

Seamless and integrated experience: Maya is not just a digital wallet; it also offers a savings feature that lets you make your money work harder. With Maya, you can easily move your money between your wallet and savings account, and all of these transactions are integrated into the app.

Daily savings interest crediting: Maya recently introduced a daily interest crediting feature for its savings accounts, so you can see your earnings up to 6% per annum on a daily basis, rather than just monthly.

More rewarding daily transactions: Maya is also offering mission-led rewards to encourage customers to save and use digital payments for everyday transactions. Until November 30, 2022, you can earn an already high base rate of 4.5% interest per annum on your savings, credited daily, by paying for purchases with Maya or settling bills through the app. You can quickly increase this to 6% in the next 30 days by paying with Maya for your everyday transactions.

Personalized Goals to manage your money: Maya’s Personal Goals feature lets you create up to five goals with set target amounts and timelines for organized tracking. Soon, daily interest rate crediting will also be available for this feature. A high-yield 6% interest rate is available until December 31, 2022.

Easy account opening and transfers: It’s easy to open a Maya Savings account, and you don’t have to worry about maintaining a minimum balance. Fund transfers to other banks and financial institutions via PesoNet are also free until December 31, 2022.

Create your credit history: Every transaction you make in the Maya app, including Savings, can help you build your credit score. Additionally, Maya provides qualified consumers with an instant revolving credit of up to PHP15,000 that they can use in their wallets or add to their Maya Savings.

Reliable and secure: Maya is reliable, with a 99.94% app uptime rate, and its digital banking services are powered by the Bangko Sentral ng Pilipinas (BSP)-licensed Maya Bank. Deposits are also insured by the Philippine Deposit Insurance Corporation (PDIC) for up to PHP 500,000.00 per depositor.

Overall, I believe that Maya Digital Bank will be a valuable partner in helping me achieve my financial goals in 2023 and beyond. The bank’s wide range of products and services, convenient digital platform, and commitment to financial education make them the perfect choice for me.

So, if you’re ready to start saving for 2023 like me, consider opening a savings account with Maya Digital Bank.

Let Us Connect:

I’m on Instagram, Facebook, Youtube, Twitter, and LinkedIn